Weekly Crop Commentary - 7/19/2024

Jul 19, 2024

Wes Bahan

Vice President, Grain Division

Good afternoon. Another week that has just flown by. I was a bit surprised on Monday night when crop ratings came out, and Ohio was lower for both corn and soybeans in the good to excellent category. I would have anticipated a 1 to 2 percent increase week on week like most of the other midwestern states had.

It sounds like most of the area got 3/4" of rain and some much more refreshing temperatures. The later-planted corn that is about to pollinate sure looks to have ideal conditions, and the early-planted corn has perfect weather for kernel filling. We sure do have the potential to have a good corn and bean crop. The pace of new crop corn and bean sales is somewhat alarming being they are the slowest in 5 years. We are starting to see a lot of movement of old crop bushels as farmers are expecting a big harvest, but the lack of exports will create some real challenges this fall. We do have good demand from the domestic markets as ethanol and soybean crush margins continue to be strong, but they still have bi-products to get rid of. This one-dimensional market hasn’t given a reason for the hedge funds to change course on their short positions. Corn isn’t quite a record yet, but they are record short in the bean market, and we will get another update on positions later this afternoon.

I do want to take a second, as I have forgotten about it for the last couple of weeks. Will Gase departed us for another endeavor, and we wish him the best. We are actively searching for a person to replace him, but in the meantime, those who worked with him can call the Upper Grain Office at (419) 294-2371 or the Delaware Office at 877-240-4393, and we will take care of you. As always, thank you for your business, and have a great weekend.

Lou Baughman

Grain Merchandiser, Kenton (Region 1)

It looks like we have found a little bit of support in the markets, but I don’t feel like we are out of the woods yet. With ideal crop weather for the next five days, traders see no weather threats for the growing season. Producers selling old crop picked up a little this week. Like Steve said last week, it is time to clean it up.

Next week starts the State Fair. Where has the summer gone? Harvest is right around the corner. Good luck to all the Jr. participants! They are so full of excitement; it makes it fun to watch them show their projects.

Steve Bricher

Grain Operation Manager, Urbana (Region 3)

The weeks just keep ticking off. Another week of July has passed, and we can start preparing for the harvest season to come. The weather was a brisk 59 degrees on my motorcycle ride to work this morning, I will take that for the 19th of July.

The markets are just treading water at this time, we may not be on the bottom, but we bounce off of it every day or so. It is hard to get a rally when crop conditions for most of the growing region are at 60 percent good to excellent. Some of the fringe areas are having issues, but for most of the Midwest, we are seeing the crop do what it is supposed to be doing. We will have to see how many acres were lost from the floods earlier this summer, the USDA should put some of that information out in the August crop report.

As I wrote last week, old crop grain needs to be cleaned up. There is a good premium for old-crop soybeans; you cannot carry them to new crops. You will give up 1.00 bushel today. Corn has carry and would pay to keep it until the new year, but you have to have a place to put the crop in the field. The prices for new crops are not very appealing, but they could be lower 60 days from now when harvest starts if we continue to see good growing conditions.

On a different note, I've been tracking new crop corn and soybean prices from January 1 until harvest for the past 20 years. If we don't see a significant rally, this will be the first time since 2000 that the new crop contract price for corn and soybeans was at its highest on January 2. This fact alone underscores the unusual nature of our current price discovery process.

Lisa Warne

Grain Merchandiser, Marysville (Region 4)

Good afternoon. The grain market continues to struggle. Reasons for any rally are few and far between. We’ve had some farmers biting the bullet this week, selling old crop just to work on getting the bins cleaned out. If you’re waiting on a return to $4 corn, I hope you’re not holding your breath.

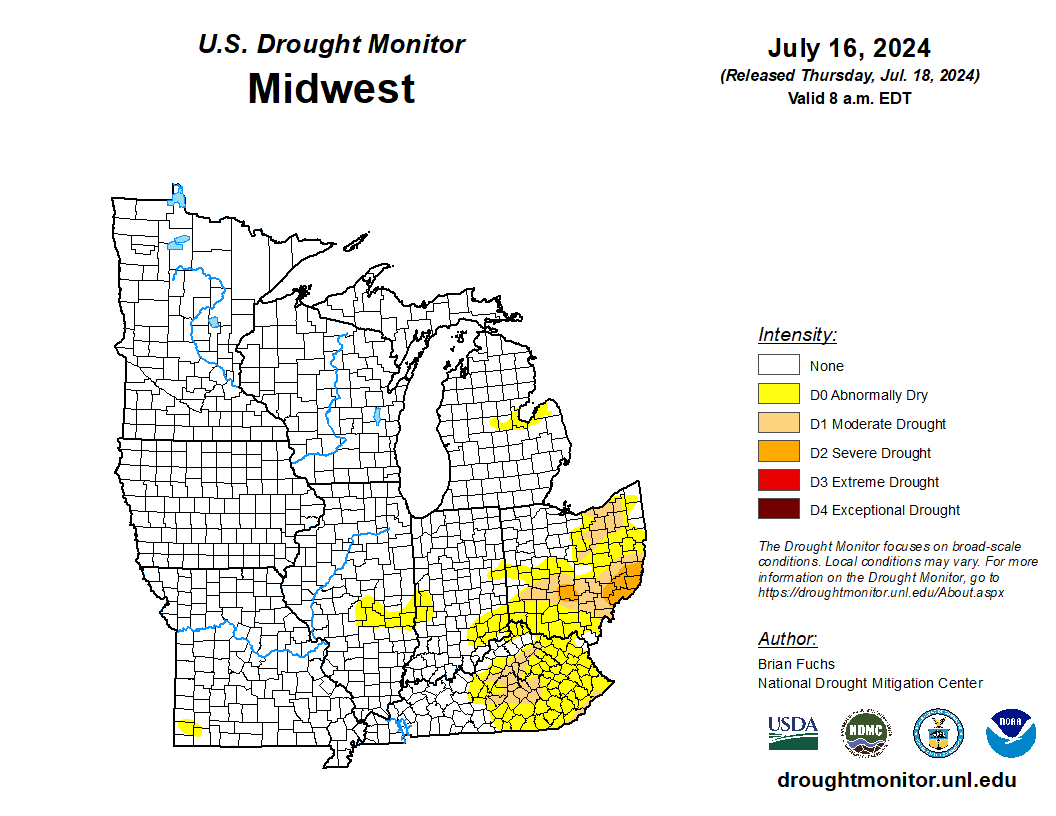

This week’s drought monitor map looks excellent for most of the Midwest, accounting for the good crop condition ratings. The exception to this is a swath through the southern part of this Heritage region. Pickaway County, which includes our Derby customers, is experiencing a D2 Severe Drought. Much of Clark and Madison counties are classified as a D1 Moderate Drought. There have been pockets of rain here and there, but it’s not adding up to enough for most folks in those areas. Let’s hope they can catch some rain soon. Have a great weekend!