Weekly Crop Commentary - 6/6.2022

May 06, 2022

Ed Nienaber

Vice President, Grain Division

The grain futures are trading weaker as we move towards Friday’s close. Both corn and beans are down twenty plus cents for the week. Weather forecasts for the coming weeks look to be much drier and hotter than the present. It appears as if we are going from spring to summer weather in the next 72 hours. Weekly crop ratings show corn at 15% planted and beans coming in at 5% in the US. Ohio is further behind at only 8% corn and 2% beans in the ground. With the improved planting conditions, we should see a drastic jump in the coming weeks. We will see continued support in commodity markets as the demand for oil-based products around the world remains very strong. La Nina’s weather event still seems to be present in the southern hemisphere, and continued concerns that will persist into our growing season this summer have added support. The basis is much stronger for bushels tributary to the Illinois River market, and it appears that is only a matter of time before it moves east. We are already seeing signs of this in the local bean processor market. Ohio River premiums are much improved on soybeans as well as export demand continues to remain strong. The USDA will release its updated supply/demand figures on Thursday, May 12. Please continue to be safe and have a great week in the fields!

Wes Bahan

Director of Grain Purchasing

As the calendar flipped to May, we started out with a couple days of fieldwork. Unfortunately, it was only a couple of days, and it appears that most are going to end the week with a couple of inches of rain accumulation. It does look like next week will warm up and have a stretch of drier weather. Let’s hope so because we need a few days to dry out for sure. The corn and soybean markets sure did carry a weaker tone this week, despite the slow planting pace. We didn’t have any flash sales from the USDA this week, and the Fed decision to raise interest rates added to the weaker tone. Wheat, however, was a different story. There were reports this week that India issued export restrictions to curb food inflation. India has helped to fill the void of Ukrainian wheat in some markets. This, along with some dry weather affecting France’s wheat crop, continued dryness in our hard red wheat growing region, and North Dakota dealing with wet conditions preventing seeding of the spring wheat crop. Let’s hope that the forecast comes true, and we can get to a drying period and back to the fields later next week.

Lou Baughman

Grain Origination, Kenton (Region 1)

The corn and bean market has faced pressure because of the forecast, predicting that the Midwest will be drying out next week with record high temperatures. Planting will accelerate in the central and eastern corn belt with the warm/dry forecast. Not much has been planted in this area.

News of France having potential wheat issues from lack of moisture, along with Ukraine’s logistic problems, and US wheat concerns, pushed the wheat market up sixty cents this week.

Ukraine reports most of the area that can be planted is complete and that nitrogen has been applied to their winter crops. This seems more optimistic than what we heard earlier. Thursday, the USDA will come out with new supply and demand numbers along with a winter wheat production forecast.

Lisa Warne

Grain Origination, Mechanicsburg (Region 3)

Welcome to Kentucky Derby weekend! Wheat has been the hot commodity this week, rallying 5%, while corn and soybeans fell back nearly 4% and 3%, respectively. We saw considerable profit-taking on Monday and Tuesday before the decline slowed midweek.

Wednesday’s market strength came from wheat news. Rumors that India would limit wheat exports due to lower production estimates because of dryness and the hottest March in 122 years. What was once expected to be a record wheat crop in India is now looking to be a 5% decrease. On Thursday, India assured they are not planning to put restrictions on wheat exports, but tight global supply concerns remain. France, the EU’s largest grain producer, is also claiming reduced wheat production due to heat and dryness.

Also on Wednesday, Ukraine accused Russian troops of stealing 400,000 metric tons of grain from facilities in southeastern regions. This amount accounts for one-third of the reserves in that area. Russia continues destroying ag infrastructure, including bombing a grain elevator in Luhansk that had a capacity of 30,000 MT. While wearing body armor, one source claims Ukrainian farmers have managed to plant 80% of their planned spring crops, albeit a reduced figure because of the war. With crops in the ground, questions turn to where they will store harvested grain as Russia continues to destroy facilities.

Turning back to U.S. domestic news, although planting progress is significantly behind historical trends, traders know that the U.S. farmer can plant at record paces. After today’s rains, the weather over the next couple weeks should allow planting progress to make substantial headway across the country.

While you wait on the fields to dry, crack open the bourbon and enjoy a mint julep while you watch The Greatest Two Minutes in Sports on Saturday. And to all the moms: Happy Mother’s Day! We appreciate you.

Steve Bricher

Grain Operation Manager, Urbana (Region 3)

It is Mother’s Day weekend and time to plant. The rain over the last week has brought any planting to a halt. After Saturday, the forecast for the next 10 days or so looks like we will have a nice warm window to get crops in the ground. While driving around Champaign County, I can see some fields planted, but nothing has emerged yet.

The corn and soybean markets have moved lower off of their recent highs. The traders are looking at the weather forecast, and they believe that we at least have a chance to get the crop in the ground. I know several customers think that it is getting late, but we have to remember that the last day for crop insurance for corn in Ohio is almost a month away. We may not get the top yield planting a little later in the month, but with new crop corn and soybeans around $7 and $14, we can still raise a very profitable crop. The other thing is we have hardly had any growing degree days, so even if we would have planted, the crop would just be sitting there.

The other news this week was the Fed raised interest rates. I know this may come as a shock to some, but I can remember when interest rates were above zero. We will have to see what this does to land prices moving forward, as a 1 percent rise in rates adds around $100 a year per acre to the cost of a loan.

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

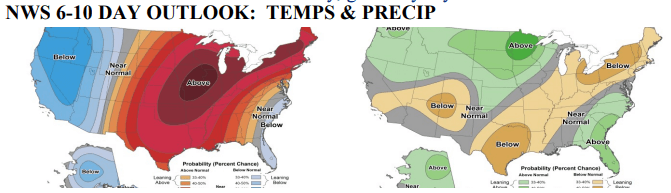

Good afternoon. 2022 planting has not made a lot of progress this week once again, but moving forward from Sunday, it sounds like temps will finally change to above normal, and precipitation goes to below normal in the 6-10 forecast this morning.

The corn and soybean markets are reacting to the news this morning, and both are seeing some selloff here currently. As I write this, we are seeing corn down .15 cents and beans down .20 cents. We know how quickly the American Farmer can put the crop in the ground with the size of equipment they have today. The market is looking for modest planting gains on Monday’s crop planting progress, but the market today is really looking ahead to the next Monday (May 16th report) for a great deal of progress.

The corn and soybean markets are reacting to the news this morning, and both are seeing some selloff here currently. As I write this, we are seeing corn down .15 cents and beans down .20 cents. We know how quickly the American Farmer can put the crop in the ground with the size of equipment they have today. The market is looking for modest planting gains on Monday’s crop planting progress, but the market today is really looking ahead to the next Monday (May 16th report) for a great deal of progress.

We continue to hear a lot of information coming out of Ukraine about how much grain is being shipped via rail to Poland and how the spring planting is going. The reports continue to sometimes show a mixed bag of information. Ukraine is getting some grain shipped out of the country, and planting is also happening. Both are positive as we move ahead into this next year, but we also know that grain movement is greatly reduced by the way that they are having to move it, and we are a long way from knowing how much grain will be raised this year. The grain markets seem to have found a trading range they are happy with for today, but that all can change in a blink of an eye if there are or even if there are any perceived problems as we move forward.

Food security worldwide will continue to be at the forefront of the market’s concerns as we move forward into the growing season. We have no room for any major problems. If we do, the markets will be quick to react. Lastly, I would like to wish all the mothers out there a Happy Mother’s Day! Thanks to all of you for what you do for your family. Without you and what you do, where would we be? You deserve to be recognized not only on this one day but every day for what you do and never ask for any credit. I hope each of you know how much you are appreciated, and I also hope you have a very blessed day!

Haylee VanScoy

Grain Merchandiser, Upper Sandusky (Region 2)

A quiet end to the week with markets down and rain continuing to fall. The Upper Sandusky region has received 1.25 – 1.50 inches of rain this week, with less than 5% of our corn and beans in the ground to date. The weather certainly looks to turn around through next week, and I anticipate that we’ll see a lot of customers back in the field with warmer temps on the way.

The trade appears to be taking some profit as we go into the weekend with better planting weather on the way and a lack of confidence in the Fed’s plan to mitigate our economy’s inflationary pressure. Despite the anticipated 50 basis point rate hike on Wednesday, we continue to see the US dollar and 10-Year Treasury Note post new highs. July corn and bean futures have backed off from their highs last week, with corn dropping more than 40c and beans over 75c. Wheat has been this week’s leader as September futures have rallied over 70c off this week’s lows. A contributing factor to that rally has been uncertainty with India’s wheat crop due to extreme heat stress on their crop. Originally, they were expected to be a net exporter this year, but now could be facing a shortage and may have to consider limiting exports. On top of the issues in Ukraine/Russia and the lack of US spring wheat planted and poor winter wheat conditions, the wheat market continues to see supportive action.

Next Thursday, May 12th is the release of our next WASDE report. Reminder to continue evaluating your marketing plans as we go through planting season and have targets or floors in place to protect yourself while you’re busy in the fields. As always, feel free to reach out with any questions. Hope you all have a wonderful Mother’s Day!