Weekly Crop Commentary - 12/6/2024

Dec 06, 2024

Wes Bahan

Vice President, Grain Division

Good afternoon. Hope everyone had a Happy Thanksgiving last week. Sure was nice to take a few days and spend time with family. The corn market is having a really strong finish to end this week. The futures are working their way back to resistance levels and basis continues to gain strength. Export inspections this week were somewhat strong at 875k metric tons. One of the boats even loaded at Toledo, so NW Ohio is getting into the export game, but the Gulf continues to be the preferred shipping spot. The export sales report yesterday was really strong with 1.732k metric tons reported for the week, taking us to 58% of the estimate on the books compared to 46% on the 5-year average. It’s been a bad week for the ethanol producer though, as margins have really been hit hard, making it harder for them to buy replacement bushels. Soybeans have had a hard week in Chicago. They have just not been able to really muster any strength.

South America continues to have nice weather, so there are expectations of really big crops there. We do continue to see China buy US beans. This week it looks like they booked another four boats, according to the releases from the USDA, but they don’t have any ownership from us as we get into the Feb/March time slots. They, too, are expecting ample Brazilian supplies. Export inspections this week were just under 2.1 MMT with the Gulf, once again, being the preferred spot to load. Export sales were also strong at 2.3 MMT, taking us to 73% of the estimate on the books compared to the 5-year average of 69%. Crush margins are also struggling both here and in China. Meal continues to be a stumbling block. China’s sow herd is 3% lower again this year, reducing that much more meal demand. We will have the December WASDE report on Tuesday, so we will see what they have for world grain production. Thanks, and have a great weekend.

Haylee VanScoy

Director of Grain Purchasing

Export sales saw another strong week, with corn coming in above estimates and 11% ahead of the expected pace for the marketing year. Beans and wheat were within expectations and are still ahead of pace by 3%. There was another flash sale of soybeans to China this morning. Have we seen bulk buying ahead of South America’s potential record crop or ahead of the new US administration coming in after the first of the year? Brazil is over 90% planted on soybeans, and the crop looks promising so far. With a lack of basis appreciation in the deferred months, rallies should be rewarded, especially when pricing DP.

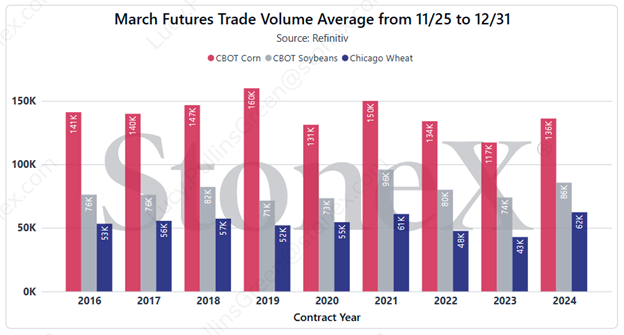

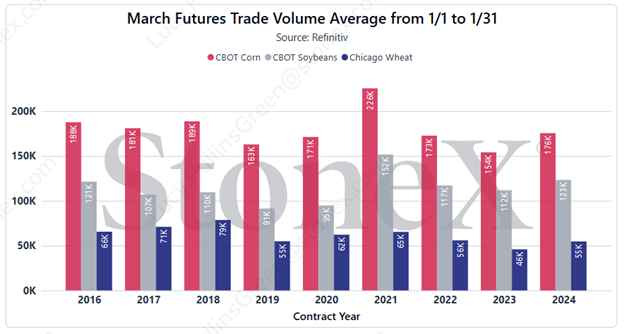

We’ve gotten into the holiday trading season, during which trade volume will be light over the next month. Check out these charts from our StoneX Bowling Green office that compared the trade volume from Thanksgiving to Christmas versus the average January daily trade volume. Despite a quiet trade, the lack of participants in the marketplace could cause some volatile opportunity if a headline hits the news. Let’s be prepared and have target offers in place! Hope you all enjoy the heat wave this weekend!

Lou Baughman

Grain Merchandiser, Kenton (Region 1)

We had a nice day for beans yesterday, bouncing off the lows, but slipping today. Corn is still in the green two days in a row. A strong dollar and export sales are leading us to the gains, but I feel we will remain in a range-bound market for a while. Basis has been improving slowly; producers seem to be hesitant to unlock the bin doors or are enjoying the Holiday season too much to move much grain. Have a great weekend.

Briana Holtzman

Grain Merchandiser, Upper Sandusky (Region 2)

I know that it seems like commodity prices can’t catch a good rally to improve, but looking back over the last 10 years of average corn futures prices, we are sitting pretty well. If we ignore the last 3 years of impressive corn prices, we are above the averages for the remaining other 7 years right now. Keeping to the idea of neglecting 2021-2023, the average corn futures price is 3.8085. For this year, we are averaging 4.2240 for corn futures. While it is hard to ignore the past 3 years, it is important to recognize the bigger picture.

There wasn’t a lot of news in the markets this week or lately at all. It seems like the only “news” affecting the grain markets is the strength of the dollar and the stock markets. Let’s keep thinking about setting targets and marketing plans for next year!

Steve Bricher

Grain Operation Manager, Urbana (Region 3)

We are now in the Christmas season, and the grain markets are range-bound. We have been, and will continue to be, range-bound until the January crop report. The markets have no reason today to go higher, as demand is muted and the crop in South America is coming along nicely. If the weather continues as it has in South America, we will see a record soybean crop there.

Basis continues to improve locally, as there is nothing moving, and the farmer seems to have his cash flow needs covered for the time being. Looking toward 2025, the picture is not great. We have adequate supplies of corn and soybeans around the world, China and other countries have economic issues that will curb demand, and if we see an end to the war in Ukraine, we could see additional production from that part of the world.

Purdue does an excellent job with its crop cost and return guide, looking at 2025 projected revenue and cost. Their projection from November has the lowest return since 2019.

As you work toward the new year, we need to get a plan in place to try to make your 2025 as profitable as possible. Give us a call, and we can help put a plan together to get your 2024 and 2025 crop marketed.

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

Good afternoon, hope all of you are doing well. After a wonderful fall season, we are finally seeing some winter weather. I also hope you all had a wonderful Thanksgiving.

Markets continue to trade at the lower end of the sideways trading range. I don’t expect to see a lot of change to that trend for the balance of December. The next big USDA report does not come until January 10th. That report is known for its surprises. I continued to be asked my thoughts as to where markets are headed. On the soybean market front, I continue to say and feel that we are stuck right now in a very range-bound market. Does that mean every day is a down day? The answer is no, but unless we start to see some problems with the South American crop, I just don’t know what moves this bean market higher. Today, the weather in South America continues to be okay. Our crush numbers are good here in the U.S., but our exports continue to lag.

The corn market is also stuck in that sideways trend as well, but I am a little more friendly to the corn market versus the beans. But please don’t take that as I’m saying I’m BULLISH on the corn market. As we move further into the winter months, I think we could see both basis and the CBOT get better. Our exports are good, and with fat cattle prices very good, I see guys holding cattle and adding some extra weight to those finished cattle, and no sign that is going to change anytime soon. The possibility of the second Safrina corn crop having some issues, I think, could translate into some support for corn.

I also think that with each day a day closer to President-elect Trump officially taking office and the threat of tariffs being imposed on other countries, that leaves some uncertainty in the markets. The one thing I would say is this: I follow StoneX Chief Ag Economist, Arlin Suderman, and he feels that even though tariffs will hurt the U.S. economy some, he feels the impacts to the other countries will be worse. Those other economies need the U.S., according to him.

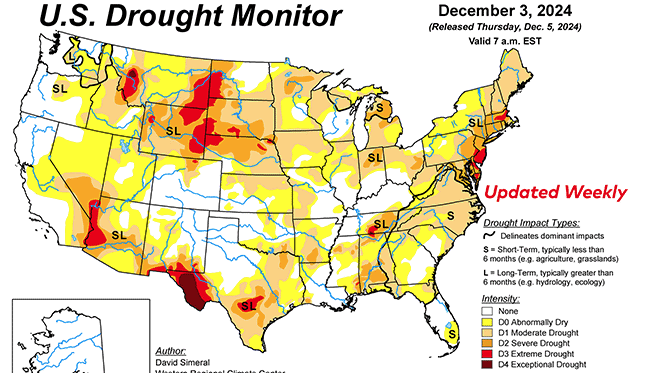

Lastly, one thing that I think warrants keeping a close eye on over the winter months is the U.S. Drought Monitor Map. Below is the most up-to-date copy of it. A large part of the corn belt is either in a Moderate or Severe Drought as of today. If we don’t get a lot of rain or snow during the winter months to replenish the subsoil moisture levels this winter, it won’t take much of a weather scare this next growing season to get the markets adding a weather premium back in. As always, feel free to give us a call to talk about these, and other things, in more detail. Have a great weekend.