Weekly Crop Commentary - 10/4/2024

Oct 04, 2024

Wes Bahan

Vice President, Grain Division

Good afternoon. Well, we are back in the harvest swing once again. That was some much-needed precipitation though. Most needed it to get wheat planted, which hopefully there is a lot of that done this weekend. The markets have had quite a run in the last couple of weeks, and we have seen a lot of corn and beans exchange hands. With cash beans at the $10.00 mark and corn for the winter above $4.00, the producer was engaged in the market once again. Basis levels have been steady for the last couple of weeks, but they are starting to feel weaker. The forecast calls for great weather the next couple of weeks, and this will cause the rail to fall behind. It happens every year, but the destruction of infrastructure in western North Carolina from the hurricane will make it much harder for a longer period. Enjoy the beautiful fall weather this weekend.

Lou Baughman

Grain Merchandiser, Kenton (Region 1)

The dust is flying again. Remember to blow the dust off your machines to help prevent fires.

Most of the beans are ready now, and the weather forecast is clear for the next fifteen days. That being said, the market may see some harvest pressure after the rally we observed last week.

Export sales for last week surpassed the expectations, and today, we had a flash sale of 4.26 million bushels of soybeans to be delivered to China and 7.79 million bushels of corn to unknown destinations. Both sales are for the current market year. Sales are still behind the USDA target, but it is still early in the season.

Briana Holtzman

Grain Merchandiser, Upper Sandusky (Region 2)

The week started off with temperatures feeling like fall but very slow, with harvest being delayed from the rain and farmers waiting for things to dry down before getting back in the field. We’ve seen more beans than corn come across the scale at the end of this week, as fields have finally dried down for harvest. Bean moistures are looking much more normal now, sitting around 13%. Thankfully, we are not seeing crop damage in Upper from rains from Hurricane Helene.

After a week of striking, the longshoremen came to an agreement to delay the strike until January 15, 2025, where they will negotiate a new contract. This delay has gotten things back open at the ports, and hopefully, will get things moving again and clear some blockage. The big talk this week, though, was the released USDA stocks report pushing corn to rally 7c. We also saw corn prices riding along with the wheat rally. Unfortunately though, things are back in the red, as the bullish momentum has run out, it seems.

Steve Bricher

Grain Operations Manager, Urbana (Region 3)

Harvest is back on. We had a week break due to the rain, but we are back at it. I had one of the biggest September harvests I can remember. We are a lot further along than we were at this time last year. Yields have just been averaging so far, but considering the weather we had in August, I guess I am not surprised.

The markets have given us a nice price boost over the last few weeks. Corn is up around 50 cents, and soybeans are up a dollar from their August lows. I have been asked why we are seeing a rally at this time. I can see 3 things. The funds have reduced their short position, so they had to buy the market to do that. Second, the weather in South America is dry at this time, so the market is a little worried about getting the crop down there going. Third, general unrest in the Middle East and the Russia and Ukraine continued war. We will have to see how the dry weather and the Middle East plays out over the next few months.

I do like pricing some new corn out of the bins above 4.00. If this is the worst price you see in the winter, I think you will be happy. Soybeans are a tough one to figure out. Demand is not great for exports, but back to my earlier comment, IF we have a problem in South America, then we could see soybeans add some value. Time will tell.

Lisa Warne

Grain Merchandiser, Marysville (Region 4)

Good afternoon! We’ve had some beautiful weather to end the week and for everyone to get back into the fields. We started getting some soybeans again on Thursday and more today. For the most part, they look okay, but we have seen some weather and sprout damage starting to show up in the early beans that were mature before the rain. Fingers crossed it won’t be a widespread concern. On Monday’s Crop Progress report, soybean harvest for Ohio was pegged at 23%, and that’s close to what I believe our area to be also. USDA had Ohio corn at 16% done, but I think our area is a little further along.

The corn market at a nice bump early in the week and is looking to close the week a nickel higher than last Friday. The bump was supported by the stocks report Monday coming in at 1.76 billion bushels, versus trade expectations of 1.844. However, it’s still higher than last year’s 1.36. Soybeans haven’t fared quite as well this week, down about a quarter. Sept 1 stocks were seen at 342 million, versus 351 trade estimate, and above last year’s 264 million.

The two-week forecast is looking great for a productive harvest. Stay safe, and we’ll see you soon!

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

Good afternoon. Harvest looks to get going again, and it looks like we should have a pretty good stretch coming over the next two weeks. We have a small chance of rain late day Sunday. Markets have bounced back fairly nice over the last month. I would not call Monday’s quarterly stocks report bullish by any sense, but I would say that it was friendly. Corn and beans both came in less than the average trade guess. Corn came in at 1.76 billion bushels, and beans came in at 342 million bushels.

As you harvest this fall, and don’t like the price right off the combine, we have some options that we can talk about for you instead of just selling or putting the crop in DP. Give us a call to discuss those options and see if we can help bring that overall average up.

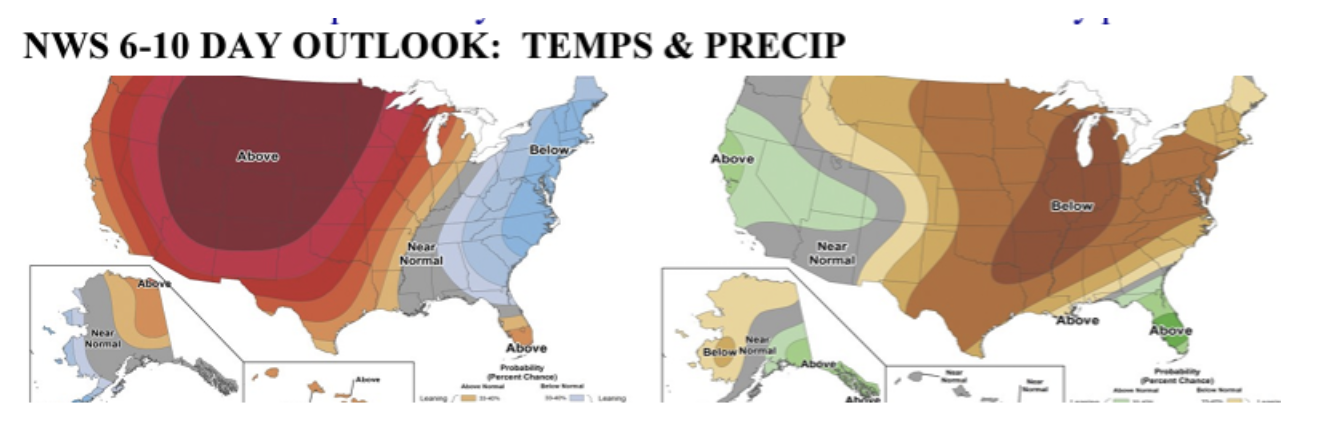

Weather in South America continues to be dry, but forecasters continue to call for better rain chances in the 6-10- & 11-15-day forecast. That has been what they've been saying for the last few weeks, and we have yet to see good rains verify. That will be a story that we will continue to monitor. We also have seen dry weather in Russia and Ukraine, and there is some talk that Russia may slow down exports leaving there. That has rallied the wheat market, as well, over last month. Keep your eyes on what NC25 wheat is doing. This may be a chance to book at some good prices.

Below is a picture of the latest NWS 6-10-day precipitation and temperatures forecast here in the states. Harvest should move right along if it holds. Have a great weekend!!!!!